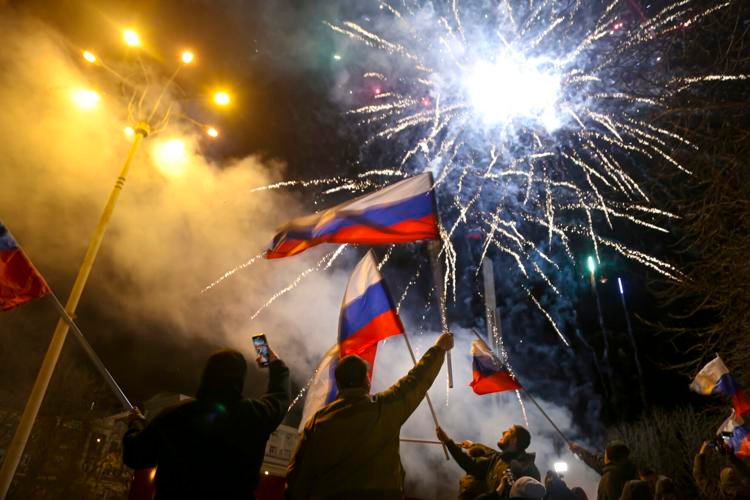

Despite the threatening sanctions issued by the west, Russia fully invaded Ukraine last week, which has heightened the tension all the world. Following this bold advancement with zero signs of retreat, the UN has planned an emergency session beginning Monday to debate and vote on a resolution to call for Russia’s immediate departure from Ukraine. Speaking in a special session on Sunday, Linda Thomas-Greenfield, the U.S. ambassador to the U.N said, “Russia cannot veto our voices. Russia cannot veto the Ukrainian people. And Russia cannot veto the U.N. Charter. Russia cannot and will not veto accountability.” India, China and UAE refrained from voting for the emergency session.

The US market continues to battle rising interest and inflation rates. The additional geopolitical tension leaves investors in a quagmire on whether the Fed is adequately ready to handle the added shocks owing to the fact that has trailed behind in dealing with the rising inflation. “The current stance of monetary policy is wrong-footed and needs substantial adjustment,” Chicago Fed President, Charles Evans, said on Tuesday. According to him, the inflation rate has largely surpassed the moderate persistent exceeding of 2% that the Fed Committee had sought earlier. While he held that a policy adjustment by the Fed was in order, he remained adamant on the extent of the planned hikes.

Owing to the more shocks hitting the economy, high volatility is expected to continue as the market dances in highs and lows. Friday closed on yet another spike following Thursday’s market correction. The Dow climbed 834.92 pts to close at 34,058.75, which was the highest among the 3 indices. Worth noting is the performance of the stocks on DJIA as none closed on a decline. DIS was the smallest gainer with 0.09% increase, while Johnson and Johnson’s was the highest with 4.97% increase. This was a huge recovery given to the huge declines in the week where only few stocks had gained. The S&P jumped 2.24% to close at 4,384.65 pts while NASDAQ increased by 1.64% to close at 13,694.62.

The futures market opened on a negative streak on Monday indicating investors’ expectations for drops in the market amidst the increasing anxiety on the likely aftermath for the war. The 10-year U.S. Treasury has remained below 2% despite the high bets on the Fed increasing the rates come March. Gold increased to over $1,900 as investors shift to more secure assets.

Major reports to be issued in the course of the week include:

- Monday: Trade in goods, advance report and Chicago PMI

- Tuesday: Final Markit manufacturing PMI, ISM manufacturing index and construction spending

- Wednesday: ADP employment report

- Thursday: Initial and continuing jobless claims, final Markit services PMI and ISM services index

- Friday: Unemployment rate, labor force participation rate and prime working age. Chicago Fed president is also expected to speak

Friday Highlights