Pressure continues to mount on the stock market as the veil of uncertainty continues to bar investors’ daily trades. NASDAQ was 1,151.02 shy of its 52-week low on Friday having shed 14.43% of its wealth in 2022 alone while DJIA and S&P 500 had tumbled 6.85% and 9.33% respectively.

The US stock market has experienced 5 distinct stock market crashes in history, which were stimulated by dynamic factors:

- The 1929 stock market crash was triggered by excessive leverage by the investors, which saw the Dow drop by 89%.

- The black Monday crash in 1987 experienced on October, 19 was mainly caused by computerized trading that automated more buys on bullish prices and more sales on bearish prices. On October 19, the market was flooded with excessive sales and the Dow dropped by 22%, which has remained the largest single-day plunge ever in history. Other factors that caused the decline were an increase in the U.S. trade deficit and geopolitical tensions in the Middle East.

- The dot-com bubble burst in 2002 was triggered by investors’ overtrading of dot-com stocks, which was followed by stringent monetary policies by the Federal Reserve leading to capital constraints on the investors. Having experienced a sharp rise to over 5,000 points in 2,000, the tech dominated NASDAQ nose-dived by 76.81% by October 2002.

- The 2008 financial crisis was fueled by increased availability of debt that that led to overcapitalization in the stock market. The Dow plunged by 54% by March 2009.

- The coronavirus crash in 2020 was instigated by the Covid-19 pandemic that swept the entire world. The S&P 500 dropped by 12% in the week of February 24 while the Dow plummeted 12.9% on March 16.

The stock market today reflects some of the past occurrences with investors fearing that the leading factors point towards an imminent distress:

- The aggressive Fed policies seeking to raise interest rates: while this move aims at curbing the continuously rising inflation and slow down the economy, the approach is likely dampen the financial performance for companies.

- Going by the Q1 reports, earnings news for several companies have been impressive with earnings surpassing expectations. Google, for instance, reported an EPS of $30.69 exceeding its expected EPS by $3.35

- While companies like Netflix reported a stifled performance, the company is set to spend $20b in its content strategy unlike the capital constraints placed on companies during the dot-com and financial crisis stock crashes.

- A distressed supply chain that is holding down companies from effective fulfillments: this poses a risk in rising logistics costs, increased production cycles, unstable inventory management and an overall poor customer experience.

- Amazon, a heavy weight on e-commerce recorded an EPS of $5.80, which was $2.23 above the expected EPS. This paves way for revolutionized models of supply chain that will set pace in dealing with the difficult economic barriers.

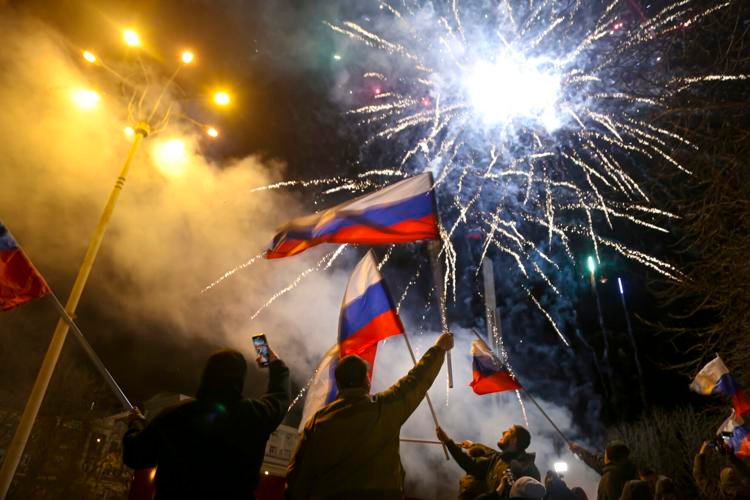

- Heightened geopolitical tension, particularly the Russia-Ukraine invasion.

- Russia and France agreed to work on a ceasefire as a meeting between Biden and Putin is underway: the move towards diplomacy is likely to steer a Russian withdrawal from Ukraine as efforts intensify to provide long-term solutions.

- China’s stand on the Ukraine-Russia stand-off boarders towards protecting its relations with the US.

Subtly said, the market is undergoing a regular decline with bulls taking the market up and bears driving it down. While the declines are significantly worrying and causing rushed scares in the market, it is still very early to call it a crash as the market has been correcting itself.

Friday’s Highlights