Putin and Powel are two names that have dominated the minds of investors in the recent past. Of late, Vladimir Putin, the president of Russia is appearing in our Wall Street news because of his recent threat to invade Ukraine. His threats have affected our market, in a big way. On the other hand, Fed Chairman, Jerome Powel is threatening to raise interest rates to slow down inflation.

Due to that, yesterday, we had a volatile trading session. Although, all the major indexes cancelled their previous 3-day losing streak. The Dow gained 422 points (1.22%) tallying at 34 988 while S&P 500 jumped by 69 points (1.58%) rallying at 4, 471.07. As usual, the tech-dominated NASDAQ didn’t disappoint. They were the biggest gainer rising by 2.5% gaining 348 points finishing at 14 139.76.

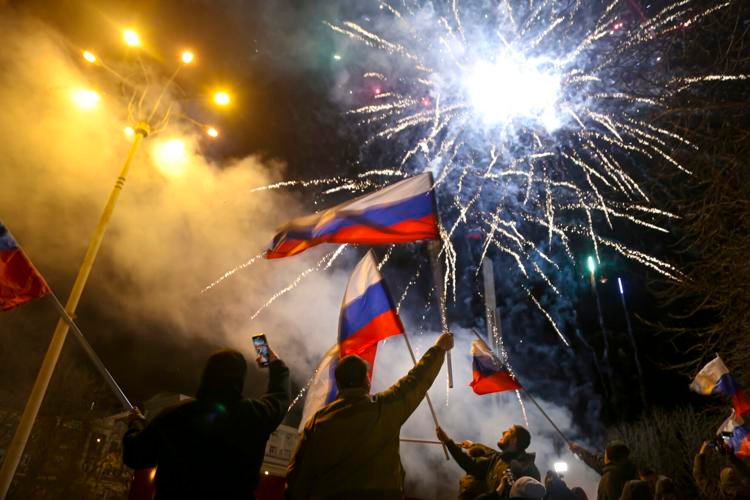

Never curse a day before sunset. Before the opening bell was rung, we received positive news that hyped the market. Moscow called back the troops, they had deployed to the southern and western districts of Russia. Putin announced that his troops have completed training exercises, thus; they have started retreating to their respective garrisons.

However, Joe Biden was adamant in his Tuesday speech. He responded with a doubled-edged knife approach. Washington is willing to use the diplomatic road to solve the Russia/Ukraine tussle. Furthermore, US allies and partners are ready to respond decisively to any Russian attack on Ukraine. Of course, our hope as investors is that they will use the diplomatic approach for the safety of the global economy.

Also, yesterday, the Bureau of Labour Statistics released the “Producer Price Index” for January, which rose by 1%. In other words, the report continued confirming that inflation is rising. Provoking Fed officials to hasten their feet in raising the interest rates. “PPI’’ rose by 1% beyond economists’ estimate of 0.5% in January. Moreover, in the last 52 weeks, “PPI” has increased by 9.7%, according to CNBC.com.

Kremlin’s decision eased the geographical tensions that we were battling. The announcement gave Wall Street market a chance to wade off external interference. Eventually, as expected, high growth stocks led by major tech companies were the first to make a rebound. Alphabet Inc, Apple Inc, Meta Platforms Inc, Microsoft Corp, Amazon.com Inc, and Tesla Inc recorded an increase of 1.1%-4.3%.

As the earning stretch comes to an end, on Tuesday, S&P 500 reported 6 new annual highs and 3 new lows. On the same note, Nasdaq Composite posted 39 new highs & 70 new lows. Also, according to reporters of Reuters.com, yesterday, the US stock market volume was 10,63 billion shares in comparison to 12.60 billion daily average traded shares for the last 3 weeks.

Today, Walmart (NYSE: WMT) is expected to announce its first quarterly earnings of the 2022 fiscal year. In their report, last year in November, they predicted to gain $6.40 per share in 2022 in comparison to their previous estimate of $6.35 per share in 2021. According to a scientific poll conducted by investing.com among analysts; 29 of 39 said that (NYSE: WMT) is likely to outperform its current ratings.