“Being Financially Literate is a Powerful Thing, Especially for Women” That nugget was shared by Otegha Uwagba, the author of “Little Black Book”: A Toolkit for Working Women. She was voicing out the challenges that women go through when trying to climb the financial ladder, in our patriarchal leaning economy across the world. Also, whenever there is a crisis, children and women are the ones who suffer most. Therefore, let us take a pause and give a virtual salute to women in Ukraine.

Yesterday the market did not improve. We are still on a losing streak, all the indexes closed on red. Dow Jones lost 797 points the largest single-day point loss in its history, -2.37%, closing down at 32, 817.38. S&P 500 tumbled by 2.95% losing 127 and by the end of the day, the reading was 4, 201.09. Also, the Nasdaq Composite had a disappointing performance, shedding off 482 points, which is a 3.62% decrease. The NASDAQ final index after the closing bell was 12,830.96.

In this volatile window, the common question among investors is, “should they buy or sell? Selling the dip to safeguard their portfolio or buying to utilize the “buy and wait strategy”. According to Katie Stockton, Founder and Managing Partner of Fairlead Strategies, the question should not be, “to buy or to sell…” The bulk stops at when should you buy the deep during this loosing streek window. She said on Yahoo Finance Live, “I think the answer really depends on their time horizon”.

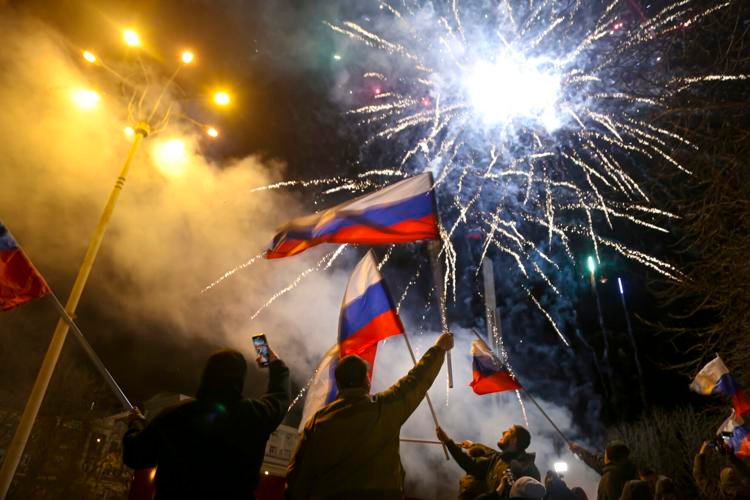

In our current investment atmosphere, they are 2 factors that we can’t underestimate. The over 7.5% rising inflation and the immeasurable Russia-Ukraine invasion. After listening to different analysts in both fields, still, we can’t’ authoritatively predict what will shrink first. Although, we don’t expect the 2 factors to take a long lifespan like that of Covid-19. However, the consequences of the 2 factors will have long-term effects.

That is why Katie Stockton argued, “we should think of ‘dips’ that are short-term in nature as opposed to having the kind of ‘buy and hold contracts.” For instance, we were counting on S&P 500 as our support level, however; we have witnessed a lot of uncertainties in the 4200. So, we must come up with new strategies for safeguarding our portfolios. And one of them is setting short-term objectives as opposed to long term, “buy and hold” strategy.

One of the latest developments from Moscow is that they are threatening to block the “Nord Stream 1 gas pipeline”, in case they keep their word it would be an economic catastrophe in Europe. According to the Russian Deputy Prime Minister, the price of oil will rise to over $300 per barrel. However, the US is exempted from that predicament because we are not an oil-dependent nation. Also, we export more oil than we import.

And that explains the reason behind the surge in Crude futures at West Texas Intermediate indexes (WTI). Yesterday, at one point, the major US oil bench marker rose to $130 per barrel before landing back. That was its topmost level since July 2008.